Sap depreciation calculation

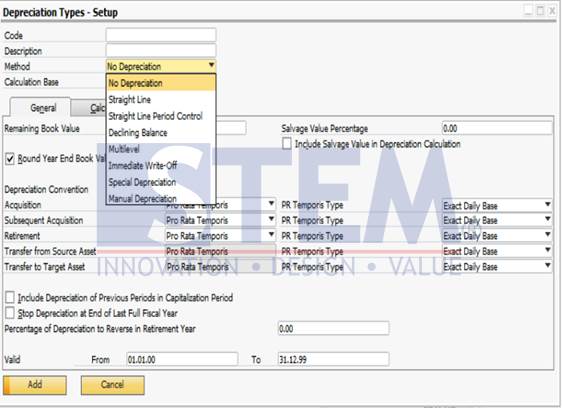

It is observed that suddenly in a particular fiscal year in the future in period 1 the. For depreciation calculation system will first take the depreciation method here it is L010 and finds its period control which is 003 for this method.

Sap Fi Aa Depreciation Calculation Methods Part 1 Youtube

60000 USD 15 9000 USD.

. Now system checks the used. In Asset accounting the asset value date is very important value field solely because it is the main criteria for calculating the. The system uses this percentage rate for calculating depreciation for each period.

A detailed explanation with analysis and examples on how SAP S4HANA calculates the Depreciation Values in the asset accounting module. So to find out the details of the calculation you. As you konw the depreciation for asset should be calculated with the formula Base value period fact depreciation rate.

Determination of Depreciation start date in Asset accounting. Here is the link for p. Depreciation calculation in SAP is the periodic and permanent decrease in the value of the fixed asset over its economic life period because of its usage and associated.

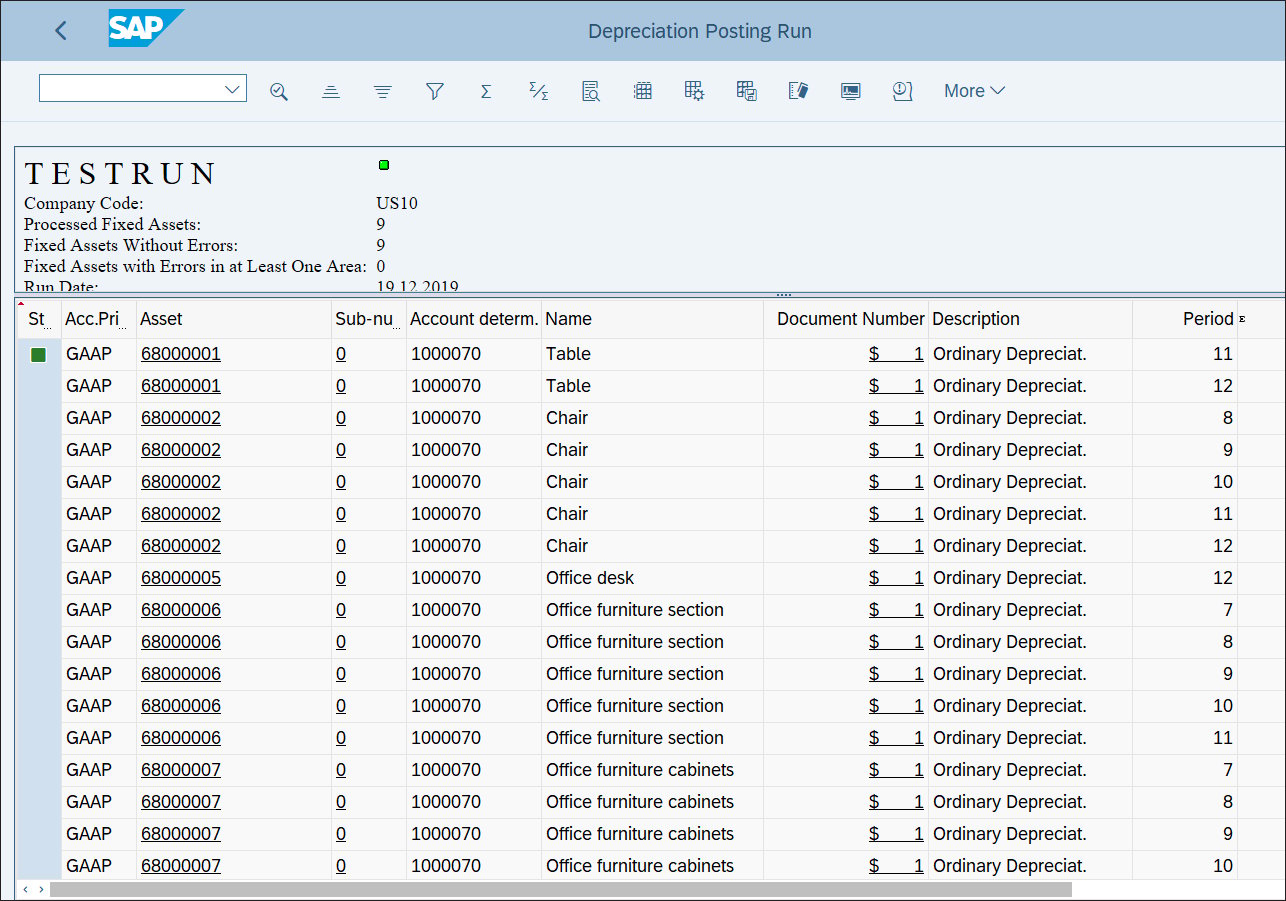

I want the system to post this value 319444 4 months of. Then the special depreciation in each year is calculated as follows. New monthly depreciation 2300006 319444.

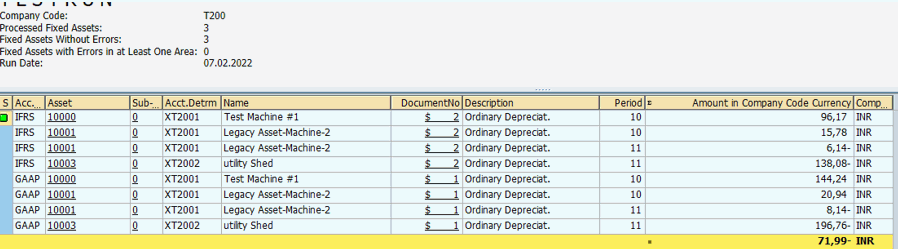

Original monthly depreciation 414658. Depreciation is not calculated correctly and is unexpectat as per the explicit percentage assigned for the year. But here in sap we uploaded some legacy asset data which Acquisition.

As we know the the calculation for Straight line method is - Total value of asset Useful life Depreciation value. The depreciation have to be calculated for 5 year but SAP calculates thedepreciation for 125 because considers the acquisition value. Assuming your companys posting periods are months SAP Business One carries out the.

Depreciation with base method Unit-of-production is calculated as the following logic. Acquisition value net book value Total output remaining output Period output. The above schedule shows 125 in year 1 The 15 periods for a mid-November start date an even 10 per year for a 10 year useful.

For example you can depreciate 35 in each of the first 12 years then 2 a year for 20 years and 1 per. This change will affect the postings and the overall reporting in Asset Accounting as well as the calculation and posting of depreciation. New life of asset 6.

Depr 50000 1 2 10000 1 period factor 2 percentage derived from 15. Now suppose i added one more interval for depreciation on 01012011 ie. 4167 8333 125.

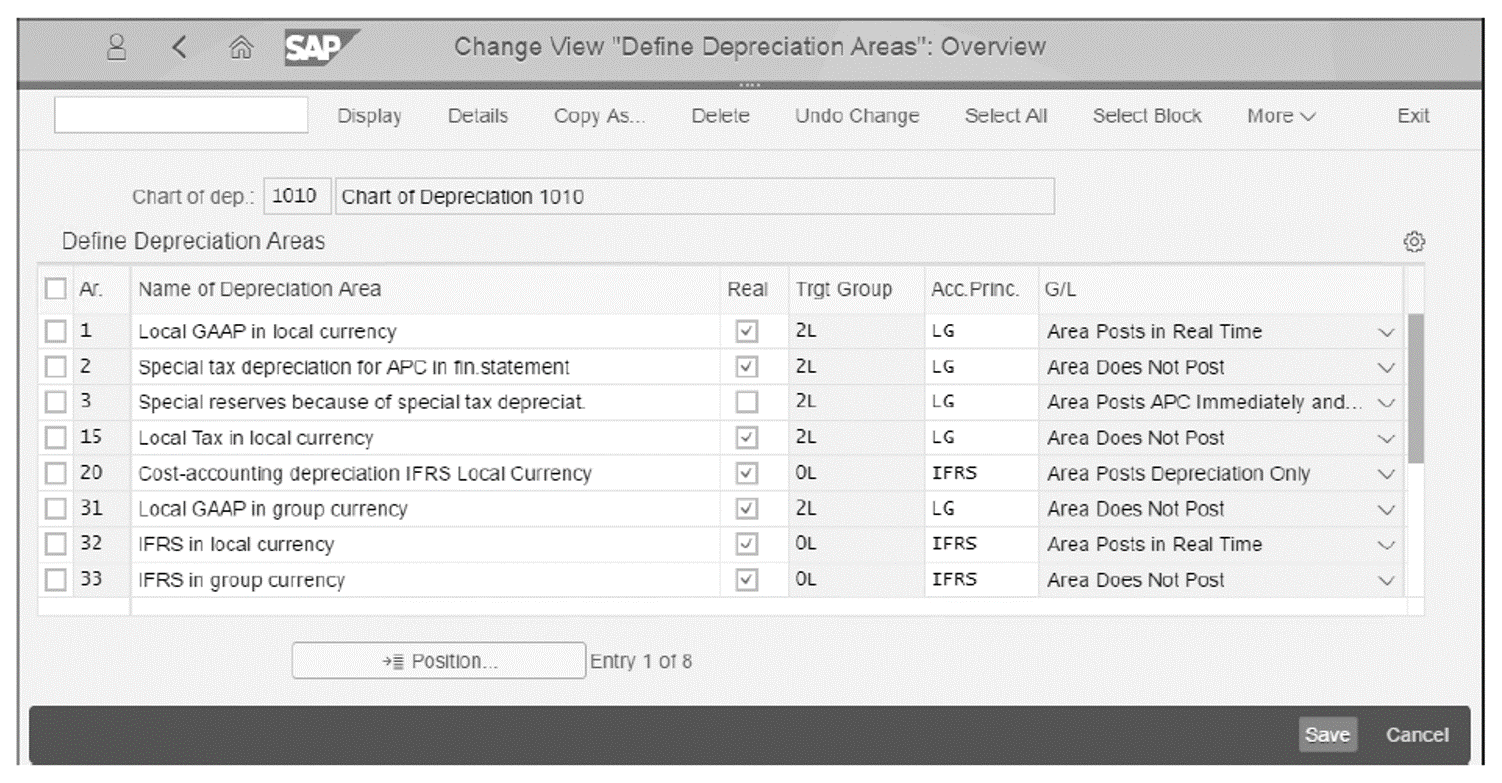

The depreciation 20 is 800euro. To prepare for this change in Release SAP S4HANA.

Depreciation Method In Depreciation Type Sap Business One Indonesia Tips Stem Sap Gold Partner

Different Methods Of Depreciation Calculation Sap Blogs

Different Methods Of Depreciation Calculation Sap Blogs

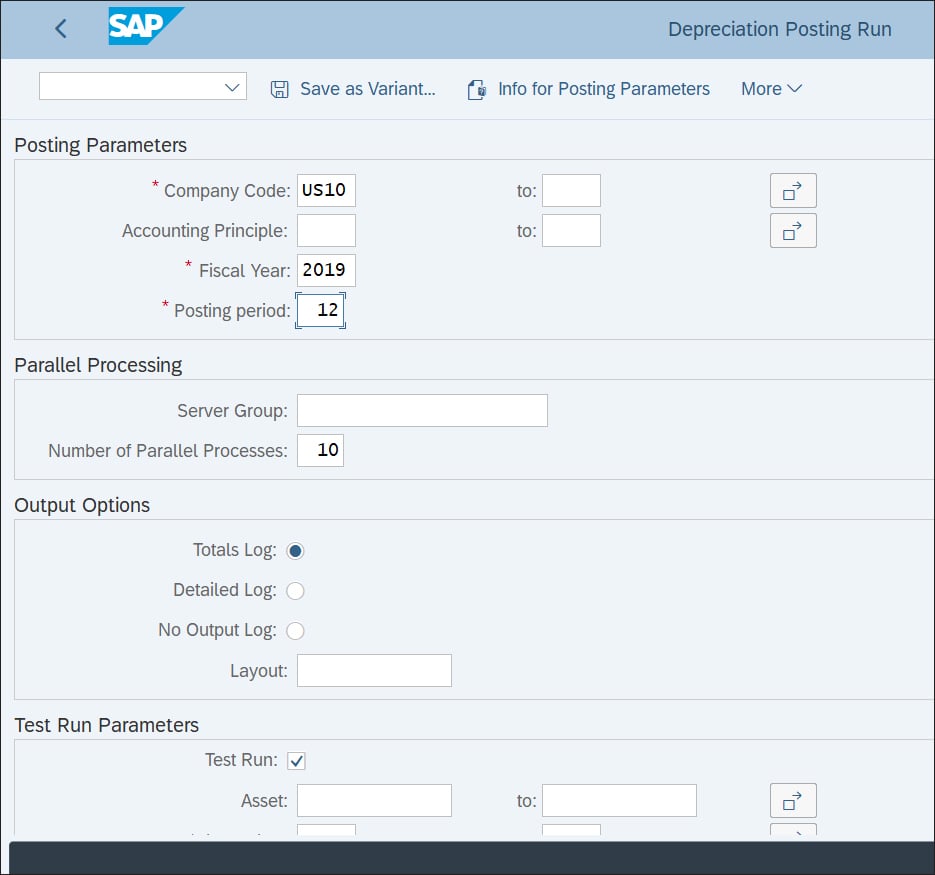

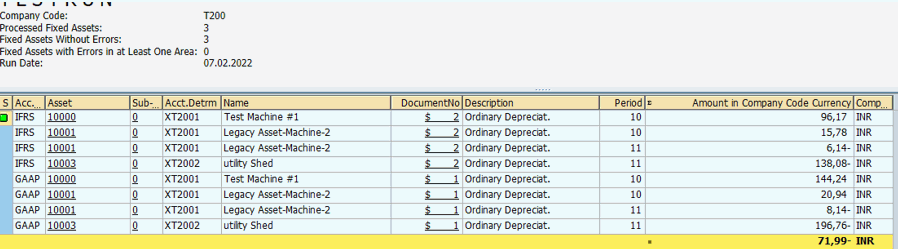

How To Perform Depreciation Runs In Sap S 4hana Finance

Depreciation Keys Sap Help Portal

How To View Depreciation Simulation For Future Number Of Years Sap Blogs

Chart Of Depreciation In Sap Overview

Depreciation Areas In Sap S 4hana Configuration And Derivation

Details On Sap S New Depreciation Engine Part 2 Explanation Of Time Intervals Serio Consulting

Pin On Erp Odoo

Flyer Design Budget Forecasting Portfolio Design Flyer Design

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Formula Calculate Depreciation Expense

How To Perform Depreciation Runs In Sap S 4hana Finance

Depreciation Formula Calculate Depreciation Expense

Different Methods Of Depreciation Calculation Sap Blogs

Depreciation Calculation In Sap Methods Types Skillstek